Government mail service may be affected by the Canada Post labour disruption. Learn about how critical government mail will be handled.

See event listings and more articles in this edition of Agri-News: March 11, 2024 issue

“Feed barley prices have moderated, a disappointment to producers holding unpriced barley in storage and a relief to livestock producers who have been feeding relatively expensive barley in recent years,” says Neil Blue, provincial crops market analyst with the Alberta government. “There are a number of factors affecting the barley market.”

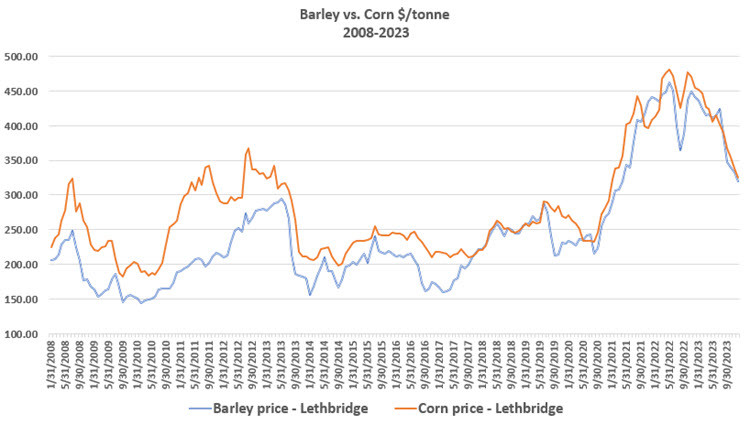

Canadian barley exports are 44% lower this crop year than year ago, and Australian barley exports to China have surged after China dropped its 3-year tariff on Australian barley. Another factor affecting barley markets is U.S. corn imports into western Canada. The main determinant of U.S. corn import volume is the comparative prices of corn and barley delivered to an Alberta feeder, particularly in the high feedgrain usage region of southern Alberta.

Figure 1. Barley vs. Corn $/tonne

“Corn is usually premium priced to barley, based on corn’s higher average energy content,” explains Blue. “During the 10-year period 2008 through 2017, Lethbridge area corn prices averaged $50/tonne higher than feed barley, which discouraged imports of corn.”

Following the 2021 drought, Lethbridge barley prices moved to a premium to Lethbridge corn prices for several months. Not only were Alberta feedgrains in limited supply, but feed barley during that period rose to record highs, exceeding $480/tonne (over $10/bushel) in May 2022.

“The price advantage to livestock feeders of corn over barley resulted in higher volumes of imported corn, and improved logistics of importing U.S. corn. The higher supply of Canadian barley following the 2022 harvest led to a drop in imported corn to Alberta during 2023 to a level similar to that of 2021. This was nearly 60% less than the 2022 corn import volume following the 2021 drought.”

U.S. corn production in 2023 was record high, resulting in a projected 60% increase in 2024 U.S. corn carryover volume, and pushing U.S. corn prices lower. Most cattle feeders prefer feeding barley but, with dryness during the 2023 growing season and concerns of reduced crop yields, livestock feeders began to forward contract their feed needs last summer, including contracting purchases of U.S. corn. That resulted in a rebound of corn imports beginning in October 2023.

“The barley price has moderated to a level more competitive in the world market, resulting in some grain companies bidding higher for feed barley, albeit at lower prices than in recent years,” explains Blue. “The lower barley prices are now more competitive with imported U.S. corn prices, stimulating more barley purchases by southern Alberta feeders lately. U.S. corn acreage in 2024 is expected to drop from 2023. Market attention will soon turn to the condition of U.S. crops, with some seasonal increase in crop prices expected.”

Contact

Connect with Neil Blue for more information.

Phone: 780-422-4053

Sign up for Agri-News

Start every Monday with the week’s top agricultural stories and latest updates.

Read about all things agriculture at Alberta.ca/agri-news