Government mail service may be affected by the Canada Post labour disruption. Learn about how critical government mail will be handled.

See event listings and more articles in this edition of Agri-News: November 14, 2022 issue

“Uncertainty is inherent in agricultural markets,” says Ann Boyda, provincial livestock market analyst with the Alberta government. “Whether it is related to weather, prices, government policies, or the global markets, all can impact farm income. The lamb and sheep sector faces its fair share of risks in business.”

Globally, production has expanded. According to the International Wool Textile Organization, world sheep numbers rose to a record 1.266 billion head in 2021. This represents a 16.9% increase since 1995 and a 0.3% increase over 2020. World ovine meat output in 2021 reached 16.4 million tonnes, up 1.8% year on year.

The 2022 production of sheepmeat is forecast to increase by 1.4% to 361 million tonnes (carcass weight equivalent). This is slower than the 4.5% increase in 2021 and driven by output in China and increases in Brazil, Australia and Vietnam. Production is forecast to decrease in the European Union, United States, Canada, Iran and Argentina.

International meat prices trended upward in 2021, reflecting higher demand due to the economic recovery, and higher costs associated with marketing and transport. However, rising feed costs put pressure on sectoral profitability. Since October 2021, global ovine prices have declined.

“Nominal sheepmeat prices are expected to remain low due partly to weaker import demand from China and the Middle East, combined with increasingly high lamb production in Australia. Sheepmeat is still considered a niche market in some regions of the world and a premium component in some diets of others. Where traditionally consumed, it may have long-term slow decline,” says Boyda.

The U.S. has experienced comparable trends. Sheep and lambs inventory in the U.S. on January 1, 2022 totaled 5.07 million head, down 2% from 2021.

Contributing to lower slaughter levels, lambs on feed showed significantly higher volumes suggesting a backlog in live lambs. More recently, this backlog is easing. The Livestock Marketing Information Center (LMIC) is forecasting sheep and lamb slaughter to be down 4.7% and 1.4% respectively for the third and fourth quarters of 2022. This would result in a 6.6% decline in annual slaughter to just over 2.6 million head.

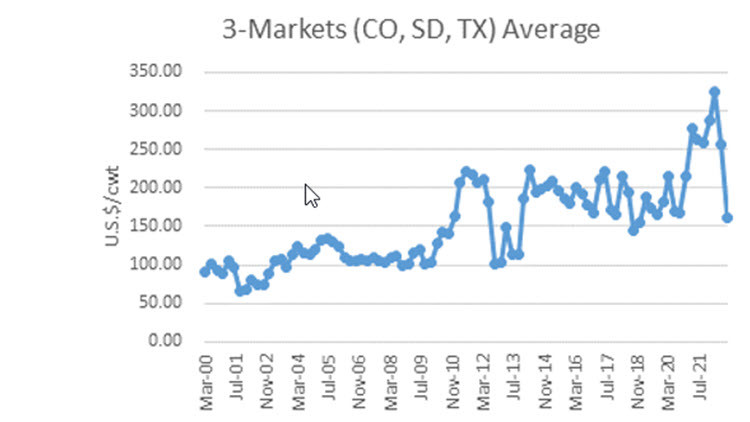

Prices as shown by the Colorado, South Dakota and Texas markets also illustrate the high volatility. Since March 2022, there has been a significant downturn in the lamb market.

Graph 1. Colorado, South Dakota, Texas Average Lamb Prices

“Traditionally, consumers are price sensitive regarding lamb. With increases in inflation, consumers may be more cautious with discretionary spending. According to LMIC, per capita consumption is expected to be 1.29 lbs in 2022, and forecast to be 1.27 and 1.18 lbs in 2023 and 2024, respectively.”

Canada is not insulated from global trends. The national herd decreased by nearly 14% to 1.077 million head since 2002. The Western provinces represent nearly 45% of the national herd, and based on July 1, 2022 inventory estimates, Alberta represents 21% of the total national inventory, second to Ontario at 30% and equivalent to Quebec.

According to Statistic Canada’s Census of Agriculture, Alberta reported an increase of 18,458 head in 2021 over 2016. Manitoba also reported an increase of 3,660 head over this period.

Since January 2018, lamb prices increased by 31.7%; however, feed costs, which represent between 40% and 60% of total production costs, have increased at a greater rate. Feed barley prices increased by 123.7% and good hay increased by 47.2% over the same period.

Graph 2. Alberta Lamb Prices

“Lamb producers face a potential future of declining demand, primarily due to macroeconomic conditions. Consumption is low compared to other meats and global pressures like the Russia-Ukraine conflict contribute more uncertainty to input costs,” explains Boyda. “Managing through these uncertain times will require having a close eye on input costs, tapping into business risk management programs and looking at options for contingency, such as AgriInvest, or diversification.”

Contact

Connect with Ann Boyda for more information:

Phone: 780-422-4088

Sign up for Agri-News

Start every Monday with the week’s top agricultural stories and latest updates.

Read about all things agriculture at Alberta.ca/agri-news