Government mail service may be affected by the Canada Post labour disruption. Learn about how critical government mail will be handled.

See event listings and more articles in this edition of Agri-News: March 4, 2024 issue

“The Alberta sheep and lamb sector is facing smaller inventories, fewer breeding and replacement stock and anticipated lower lamb crop for 2024,” says Ann Boyda, provincial livestock market analyst with the Alberta government. “However, optimism exists for continued easing of production costs and stronger lamb prices. The industry still faces challenges due to the declining flock numbers and consumer concerns of high food prices, but demand remains stable.”

Sheep and lamb inventory

According to Statistics Canada’s total sheep inventories released on February 23, 2024, January 1, 2024 Canadian inventories of sheep and lambs were down 2.2% over January 1, 2023 to 828,300 head. The sheep breeding herd declined 2.3% to 599,300 head, with ewes down 2.4%, rams down 0.84% and replacement lambs down 3%. Market lambs and lambs under one year declined 2% since January 1, 2023.

Statistics Canada reported Alberta total sheep and lamb on-farm of 170,100 head, 1.96% lower than last year January 1. The greatest decline of 2.71% was reported for replacement lambs. The lamb crop (lamb under one year) was down 2.22%. Ewe and ram inventory were down 1.8% and 1.9%, respectively, for the same period.

Alberta has risen to the second largest sheep and lamb producing province, just surpassing Quebec by 1700 head on-farm as of January 1, 2024. Ontario still holds the top position with 261,400 head on-farm. Except for Nova Scotia and New Brunswick, all provinces reported a decline in inventory over the last year. Statistics Canada attributes the decrease to lower prices and increased feed costs.

Slaughter

Slaughter volume in 2023 at federally inspected facilities for West Canada, including Ontario, is reported by Statistics Canada at 86,692 head, a 0.2% increase over 2022 following 3 years of consecutive decreases in slaughter numbers. The West Canada slaughter volume represents 51% of the total slaughter in federally inspected establishments. Slaughter volume through 2023 followed typical seasonal trend associated with holidays and special religious events.

Prices

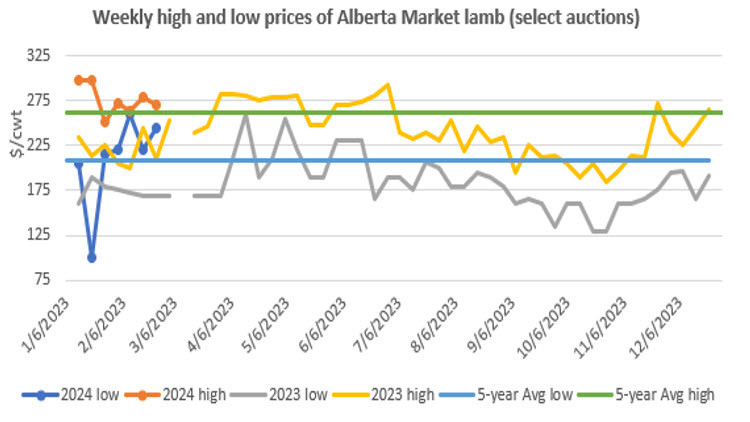

Prices for market lamb at select Alberta auctions were estimated to range between $209.29 to $276.14 per hundredweight year-to-date (February 23, 2024). These prices were on average 20-26% higher than the same period in 2023. The average prices in 2023 were 8.2-12.5% lower than the 5-year average of $260.92 per hundredweight high and $209.01 per hundredweight low.

Figure 1. Weekly high and low prices of Alberta Market lamb

Source: Alberta Agriculture and Irrigation

Cash price of feeder lamb at select Alberta auctions exhibited comparable seasonal patterns; however, the average low and high range of $276.29 and $358.00 per hundredweight year-to-date (February 23, 2024) were 3.5% lower and 3.4% higher than the low and high prices for the same period in 2023. The average low price for 2023 of $199.29 per hundredweight and high range of $263.33 per hundredweight were 39% and 23% higher than the 5-year averages, respectively.

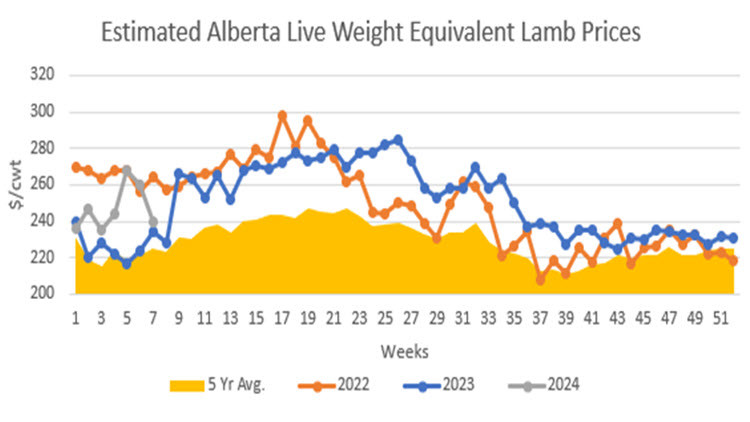

Year-to-date (February 16, 2024) live weight equivalent lamb prices were estimated at $247.06 per hundredweight, an increase of 9.2% over same period last year. The average price for 2023 was estimated at $249.60 per hundredweight, which also represented a 9% increase over the 5-year average price.

Figure 2. Estimated Alberta Live Weight Equivalent Lamb Prices

Source: Alberta Agriculture and Irrigation

Trade

Sheep supply and disposition data from Statistics Canada estimates Alberta interprovincial export of sheep and lamb for 2023 of 15,400 head, up 7.7% over 2022. Interprovincial imports for 2023 were estimated to be 12,200 head, up 17.3% from 2022. International imports of 6,900 head were reported for the first half of 2023, with no international imports in the second half of 2023.

According to Agriculture and Agri-Food Canada, Canada imported nearly 22,221 tonnes of lamb and 4,277 tonnes of mutton in 2023. Data from the Agri-Food Trade On-line indicates that Alberta imported 6,949 sheep in 2023, down by 11,241 head from 2022 (2022 being the highest number of imports in the last 10 years). Alberta also imported 3 tonnes of sheep lamb and mutton cuts in 2023.

“As producers watch the drought monitor, feed costs and market prices, there may still be room for optimism in the first half of this year,” says Boyda. “The U.S. market could hold some promise but competition from Australia and New Zealand is stiff, especially considering the slower Asian economies. The expectation is that lower U.S. production in the first half of 2024 would see lamb prices recover.

“In addition, the upcoming lamb holiday market presents opportunities to the lamb sector. March should see an inventory buildup for the Easter holiday. In addition, Ramadan celebrations should influence demand. Eid al-Fitr (Festival of Fast-breaking) and Passover in April usually feature lamb products.”

Contact

Connect with Ann Boyda for more information.

Phone: 780-422-4088

Sign up for Agri-News

Start every Monday with the week’s top agricultural stories and latest updates.

Read about all things agriculture at Alberta.ca/agri-news