Government mail service may be affected by the Canada Post labour disruption. Learn about how critical government mail will be handled.

See event listings and more articles in this edition of Agri-News: February 12, 2024 issue

China is the world’s largest producer, consumer and importer of pork. Reuters reported that China produced a record 57.94 million metric tons of pork in 2023. Fourth quarter of 2023 showed that China increased slaughter to cut losses amid an oversupply of pigs and an outbreak of African swine fever. Pork output for 2023 rose by 4.6% from a year ago.

“There is an imbalance between supply and demand for pork in China caused by huge losses and an accelerating move away from pork as the preferred meat,” says Ann Boyda, provincial livestock market analyst with the Alberta government. “On the supply side, farmers increased production in response to swine fever losses and large-scale operations comprised a greater share of the market.”

African swine fever continues to plague China, hitting the small and medium farmers the worst. Pig production transitioned to more remote areas to help address biosecurity risks. The government implemented policies to support highly integrated pig enterprises with the view of ensuring food security for its large rural and migrant populations.

In China, on the demand side, the large lower income population is price sensitive and facing economic challenges. China’s economy is pressured by its financial problems in the property sector which was over built and could take a long time to rebalance. The middle to high income population appears to be turning away from pork as the dominant meat due to changes in its flavour profile. The large-scale industrial production system is generating a product with different genetics and inputs, unfamiliar to the Chinese palate.

“BNN Bloomberg reported that China’s pork production in 2023 rose to the highest level in 9 years and the government still bought pork to lift prices. Larger supplies coupled with weakened consumer demand resulted in a slowdown in China’s 2023 import volumes. The volatility in China’s pork market is a major source of uncertainty for exporters.”

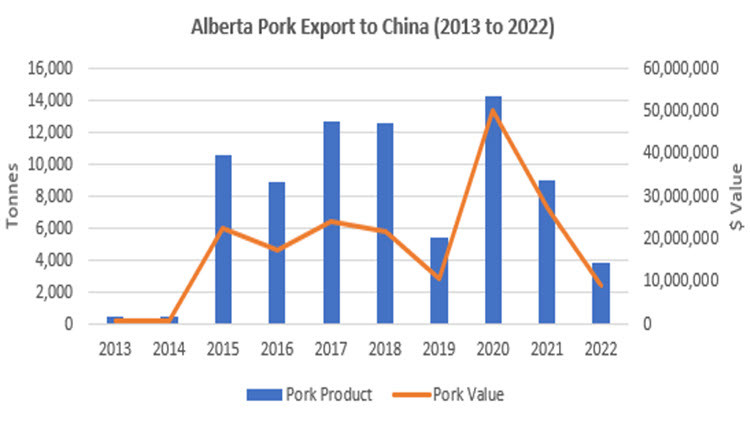

In 2022, Alberta exported $540.2 million in fresh, frozen and chilled pork product, of which $9.125 million or 1.7% of the total value of Alberta pork exports, was destined to China. Over the last decade, China’s share of Alberta pork export value ranged from 0.2% in 2013 and 2014 to nearly 9.8% in 2020.

Figure 1. Alberta Pork Export to China

“China’s economic slowdown and declining population point to a further deteriorating import volume,” explains Boyda. “Alberta pork exporters faced with global over supply will likely need to focus greater efforts on southeast Asian countries. With the continued contraction of hog production in the European Union, prospects for these markets look promising.”

Contact

Connect with Ann Boyda for more information:

Phone: 780-422-4088

Sign up for Agri-News

Start every Monday with the week’s top agricultural stories and latest updates.

Read about all things agriculture at Alberta.ca/agri-news