Government mail service may be affected by the Canada Post labour disruption. Learn about how critical government mail will be handled.

See event listings and more articles in this edition of Agri-News: February 5, 2024 issue

“Agri-businesses continually adapt to changing input prices, especially during periods of volatility, high inflation and supply chain issues,” says Azam Nikzad, market analyst/coordinating researcher with the Alberta government. “Farm input costs represent an upfront purchase necessary for production and encompass a range of items including fertilizer, chemical, seed and feed. Rising farm input prices are concerning as they contribute to higher farm operating expenses.”

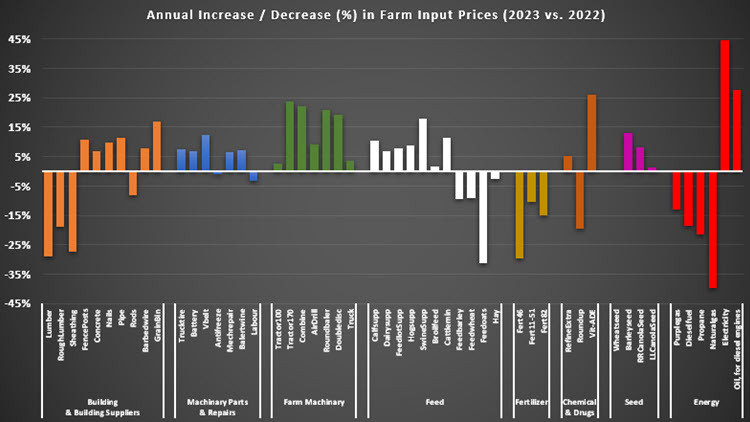

According to Statistics Canada, farm operating expenses increased by 20% in 2022 compared to 2021 and their farm input price index for Alberta is up 9.6% in third quarter 2023 compared to third quarter in 2022. To better understand farm input prices trends in Alberta, the analysis below compares the annual percentage change in yearly averages for select farm inputs in 2023 versus 2022.

The most significant upward shifts were observed in the price of electricity, followed by oil for diesel engines, which rose by 44.6% and 27.6%, respectively. Conversely, purple gasoline, diesel fuel, propane and farm natural gas prices decreased by an average of 23.1%, primarily driven by lower global natural gas and crude oil markets. Fertilizer showed an average price decrease of 18.2%, with the most significant decline observed for urea, which was down 29.5%.

Farm machinery prices increased 14.4% on average, whereas machinery parts and repairs experienced an average uptick of 5.2%. Seed prices were up on average 5.6% and feed prices increased 1.1%, with the most notable increase seen in the price of swine supplement at 17.9% while feed oats experienced the largest decrease at 31.3%.

In terms of crop chemicals and livestock drugs, the highest rise was observed for vitamin ADE (up 25.9 %) and the most significant decrease was for Roundup (down 19.6 %). Building supplies saw an average decrease of 1.9%, with the largest decline noted for lumber, followed by sheathing prices.

Figure 1. Annual Increase/Decrease (%) in Farm Input Prices (2023 vs. 2022)

“The farm input market has faced many challenges in recent years, from logistical hurdles and labour market disruptions to interruptions in the production of base inputs for manufacturing, congested delivery channels, rising wages, global supply concerns and escalating transportation costs,” explains Nikzad. “This unprecedented confluence of challenges had tangible impacts on the escalation of farm input prices.”

For instance, fertilizer and fuel prices saw a sharp surge in October 2021, which was then intensified by the Ukraine-Russia conflict in February 2022. Russia is the major exporter of both fuel and fertilizer. The conflict escalation increased the level of uncertainty around supply and demand conditions and led to a spike in prices.

Inflation pressure in the economy is another factor that can push up farm input prices. The Centre for Commercial Agriculture notes a strong correlation between changes to the inflation rate and prices for labour and machinery and other farm inputs. Inflation can result from increased demand that surpasses an economy’s capacity to produce, or from geopolitical risks, rising production costs, labour shortages, wage increases and supply chain challenges.

Global fertilizer, chemical and other manufacturers have adapted to disruptions and increased the level of resilience across their respective supply chains. Efforts were helped by lower costs for raw materials (in the case of chemicals) and lower natural gas prices. Natural gas is a key input for nitrogen-based fertilizers, which has in turn contributed to the notable decline in fertilizer prices.

“There is a diversity of perspectives on where farm input prices could go in 2024,” says Nikzad. “Some foresee the potential for further increase due to continued global uncertainty, the energy transition, ongoing supply constraints and improved Chinese demand. Others take a more optimistic view and expect farm input prices to moderate. Much will depend on energy prices and global demand for farm inputs.”

Contact

Connect with Azam Nikzad for more information:

Phone: 780-422-0264

Sign up for Agri-News

Start every Monday with the week’s top agricultural stories and latest updates.

Read about all things agriculture at Alberta.ca/agri-news