Government mail service may be affected by the Canada Post labour disruption. Learn about how critical government mail will be handled.

See event listings and more articles in this edition of Agri-News: April 15, 2024 issue

“Alberta is a major pork exporting jurisdiction and the pork sector is a sound contributor to the provincial economy,” says Ann Boyda, provincial livestock market analyst with the Alberta government. “In 2022, the Alberta agriculture and agri-food sector contributed $11.2 billion in gross domestic product and employed approximately 69,000 Albertans.”

In 2023, Alberta slaughtered 2.727 million hogs in federally inspected facilities, 1.784 million of Alberta origin. Alberta produced 2.169 million market hogs, with an estimated 82% processed in Alberta, 11% processed in British Columbia, and 6% in Manitoba. Alberta has an estimated 13% of the hog processing capacity in Canada

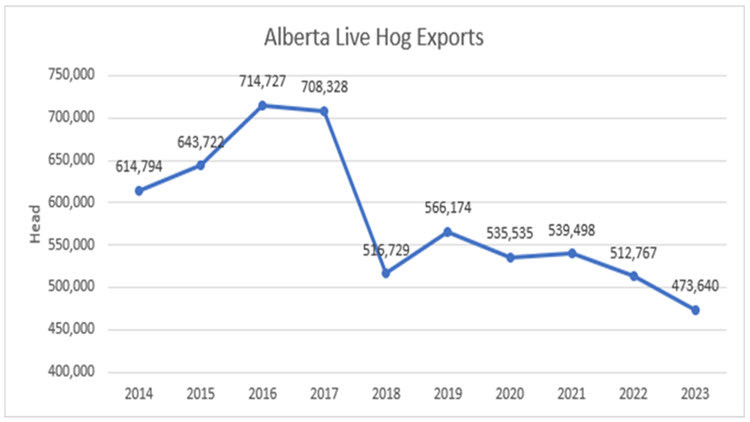

Over the last decade, live hog exports have declined from the peak of 714,727 head in 2016 to the low of 473,640 head in 2023. USDA suggests that the first quarter of 2024 may see larger market hog exports. Expansion in sow slaughter in Western Canada is suggested to see fewer cull sow exports. USDA has projected feeder exports will increase slightly in 2024, especially out of Western Canada.

Figure 1. Alberta Live Hog Exports

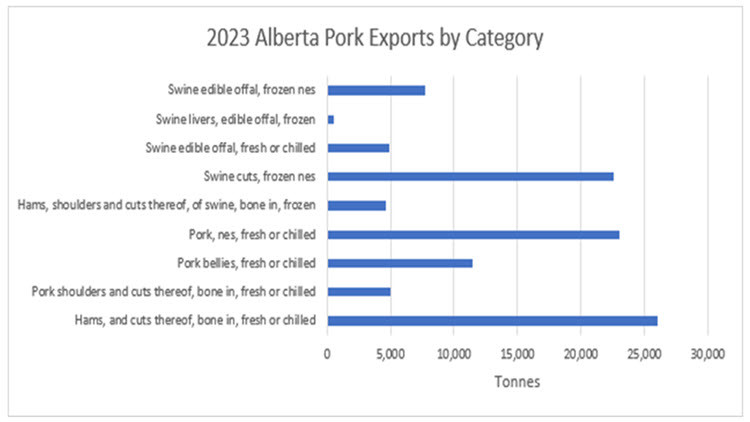

Alberta exported 105,840 tonnes of pork product valued at $354.2 million in 2023. This volume was down 26.5% from the prior year and the export value declined by 34.4%. The greatest share of pork (28.3%) was chilled or fresh pork, followed by frozen swine cuts (19.4%), bone in fresh or chilled hams (18.9%) and fresh or chilled pork bellies (16.1%). Fresh or chilled bone in pork shoulders comprised 7% of the total export volume. Frozen edible offal, frozen bone in hams and shoulders, and fresh or chilled edible offal comprised 5.3%, 3.4% and 1.4% of export volume, respectively.

Alberta’s top export market remains the United States (U.S.) with 43,474 tonnes of pork product valued at $140.5 million, representing 39.7% of the market share. Japan is Alberta’s second largest market representing 28.7% of the total export value at $101.6 million and 18,930 tonnes of pork. Mexico represents Alberta’s third major market for pork at $48.6 million or 20,089 tonnes. Alberta also shipped 10,712 tonnes of pork to China, valued at $22.3 million and 6,947 tonnes of pork to the Philippines, valued at $18.5 million.

In terms of export volume, fresh or chilled bone in hams represent the largest export category with 63.2% destined for Mexico and 36.8% destined for the U.S. Approximately 54.6% of fresh or chilled pork was destined for U.S. and 41.4% to Japan. Japan was also the major market for fresh or chilled bone in pork shoulder (83.4%).

Figure 2. 2023 Alberta Pork Exports by Category

“Alberta’s swine sector performance has faced challenges, but there are recent signs of Alberta’s hog margins improving,” explains Boyda. “Except for June through October, producers experienced nearly 7 months of financial losses in 2023. Losses did extend into the first 2 months of 2024 but have finally rebounded in March.”

At a March 28, 2024 webinar hosted by National Pork Board, Brett Stuart of Global AgriTrends shared that the U.S. hog sector reported financial losses for 12 of the past 14 months. The China hog sector, plagued with disease issues, weak demand and over supply, faced 23 of the past 30 months with producer losses.

The European Union (EU) also witnessed significant liquidation in its hog sector due to rising costs and environmental policies and is projected by USDA to continue to decline through 2024. Liquidation in EU markets provides export demand opportunities for Alberta pork, but Alberta must compete with U.S. and Brazil. U.S. has increased its pork exports by 17% from a year ago.

“Alberta will also need to navigate climate and environmental policies such as California’s Proposition 12 regarding requirements for hog farrowing operations and the resulting impacts of compliance on production costs. In addition, protectionist regulations such as the proposed Product of USA labelling rule could inhibit trade, even if voluntary. The upcoming U.S. election may also introduce more uncertainty with respect to trade policies.”

One final factor influencing global hog markets is African Swine Fever (ASF). The outbreaks continue in 52 countries. There have been 5 new European countries added to this list in 2023. Canada currently has ASF zoning arrangements with U.S., EU, Singapore, Vietnam and Hong Kong. Agreements with Japan and United Kingdom are being worked on and on-going discussions are underway with Colombia, South Korea, Chile, Mexico, Philippines and Peru.

“Zoning agreements are imperative to market access should an incidence occur in Canada. The Canadian and Alberta industry and governments continue efforts for preparedness, recognizing that effectiveness of zoning and biosecurity measures are paramount to attaining agreements, as is demonstrated controls should an outbreak occur in wild boar,” says Boyda.

Contact

Connect with Ann Boyda for more information:

Phone: 780-422-4088

Sign up for Agri-News

Start every Monday with the week’s top agricultural stories and latest updates.

Read about all things agriculture at Alberta.ca/agri-news