This release was issued under a previous government.

Alberta contends that this attempted offload is being implemented through a regulatory clause that was unlawfully enacted when the province's electricity system was deregulated.

This clause was lobbied for by Enron, a discredited and now bankrupt US electricity operator at the centre of numerous other controversies and questionable business practices.

The “Enron clause” purports to give power companies the option to hand off unprofitable Power Purchase Arrangements (PPAs) to the Balancing Pool, effectively passing their financial losses and risks on to consumers. It is estimated that the clause will cost up to $2 billion between now and 2020, when PPAs are set to expire.

“The previous government sold deregulated electricity as a way to transfer financial risk to the private sector in return for giving them the chance to earn greater profit. In secret, they did the opposite - setting up a system where consumers bear all the risk. Albertans should not be on the hook for these backroom deals.”

“On behalf of the Alberta government, we will be challenging the 2000 action that created the loophole clause that PPA Buyers are now relying on to escape their legal obligations. We will argue that the government had no legal authority to make this change - especially not in closed-door proceedings after a PPA public hearing process had concluded - and the clause is therefore void.”

The court action began today with an originating application for judicial review and declaratory relief. The application seeks an order declaring the Enron clause void in law and an order quashing a recent decision by the Balancing Pool to accept the return of Enmax’s now money-losing Battle River 5 PPA to the Balancing Pool.

Background

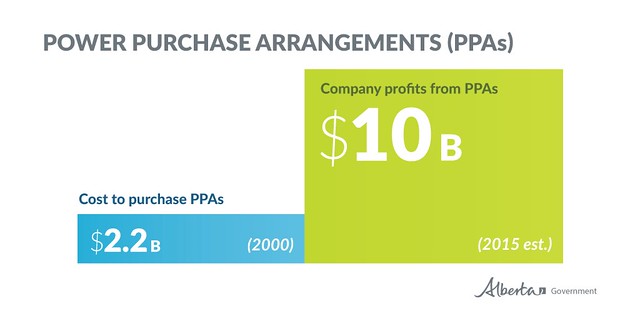

Power Purchase Arrangements, or PPAs, were created in 2000 to move Alberta’s electricity system from a regulated to a competitive deregulated market. The PPAs took effect in 2001. PPA Buyers would bear the risk of buying and selling electricity in Alberta in return for the opportunity to collect greater profits. PPA Owners – the power generating companies – continued to be paid by PPA Buyers as though the system were still regulated. PPA Buyers have collectively profited an estimated $10 billion since PPAs were established.

Facing poor market conditions, four PPA Buyers have applied to terminate their PPAs early, based on an unlawful agreement made behind closed doors between Enron and a former government. This “Enron clause” was designed to allow unprofitable PPAs to be returned to the Balancing Pool if any government action, no matter how small, increased their costs.

No corporation that has returned a PPA to the Balancing Pool on the basis of the Enron clause has claimed that government action has rendered them unprofitable. In all instances, the surrenders involve PPAs that will be unprofitable from 2016 to 2020 because of market forces, despite the significant profits they made when market conditions were better.

If these PPAs are terminated as the power companies want, their losses would be transferred to a financial account called the Balancing Pool, which is wholly funded by residential and commercial electricity consumers. If these PPAs are permitted to be returned to the Balancing Pool on the basis of the Enron clause, losses associated with these PPAs are estimated to be as much as $2 billion by 2020.

To protect consumers, the Government of Alberta is taking legal action to have the Enron clause declared unlawful and void, and to overturn the Balancing Pool’s decision to accept the return of the Battle River 5 PPA.

Timeline

1996

The government proclaims the Electric Utilities Act, introducing competition to Alberta’s electricity market. The act implements PPAs, which govern the relationship between owners of power-generating facilities (“PPA Owners”) and intermediaries (“PPA Buyers”), which purchase electricity from PPA Owners and sell it to Albertans.

1998

The government appoints an expert body, the Independent Assessment Team (IAT), to consult with the public and stakeholders on PPAs and provide recommendations to the Alberta Energy and Utilities Board (AEUB).

1999

In July, after a full year of consultations, the IAT files its report, including copies of PPAs, with the AEUB. The AEUB issues a public notice to interested parties, who are given the opportunity to make “requests for variance” to the PPAs.

Under the act, the AEUB will vary the PPAs if it is satisfied that either (a) the IAT hadn’t carried out its duties in accordance with the law, or (b) the IAT recommendations are obviously unreasonable, not supported by economic analysis, or not in the public interest.

The AEUB convenes further public hearings, attended by key stakeholders, to consider the variance requests. At the end of the year, it issues a decision stating that none of the parties had persuaded it that any of the above conditions were met. Accordingly, it made no variations to the PPAs.

2000

In May, the AEUB issues an order approving the PPAs, as submitted by the IAT. Within the now-published PPAs is a provision stating that power companies can terminate their PPAs, without liability, if a change in government law renders their arrangement unprofitable.

In July, a representative of Enron (later a bidder in the PPA auction) lobbies the IAT to add the words “or more unprofitable” to the provision. Enron further argues that the PPAs be made into a regulation, something that was neither required by law nor previously considered by the AEUB.

On August 1, the IAT writes to the AEUB, stating that it agrees with the change recommended by Enron. With no public hearings, and no notice to consumers or their representatives, AEUB says it agrees as well.

On August 18, the AEUB bundles its original order together with some letters from the IAT about Enron’s position, rubber stamps it, and declares it a regulation.

Three days later the first PPA auction is completed.

In September, the cabinet - with or without knowledge of how the PPA had been amended at Enron’s behest - passes a regulation exempting the board’s regulation both from the normal legal process and from disclosing it to the public.

It is this clause - created in a backroom deal and hidden from the public - that power companies believe gives them the right to hand Albertans unprofitable PPAs that could cost consumers up to $2 billion.

Our government fundamentally disputes this position. That’s why we have chosen to take up this challenge in court.

Biography: Joseph Arvay, Q.C.

Joseph J. Arvay, Q.C., holds law degrees from the University of Western Ontario Law School and Harvard Law School and is called to the Bars of both British Columbia and the Yukon.

He has a very busy litigation practice with an emphasis on public law and in particular constitutional, aboriginal and administrative law matters. Mr. Arvay has been counsel on a number of landmark cases in the Supreme Court of Canada - a court he has appeared in dozens of times.

He has also acted on cases that involve a wide variety of other areas of law including medical malpractice cases, class actions, commercial litigation, intellectual property and defamation cases. Mr. Arvay has acted for a diverse list of clients that includes public interest organizations, private citizens governments, First Nations and many public corporations.

Mr. Arvay has also been listed as “Most Frequently Recommended” in the area of Public Law Litigation in both Vancouver and Victoria in the Canadian Legal Lexpert Directory. As well he was “Consistently Recommended” in the areas of Aboriginal Law, Class Action Litigation and Corporate/Commercial Litigation. Mr. Arvay has been named as one of the top 100 Best lawyers in Canada in a publication of the same name for the last several years and in 2013 and 2015 was named Vancouver Lawyer of the Year in Public Law and Administrative Law.

Mr. Arvay has been the recipient of many awards and honours including most recently the Advocate Society’s Justice Award 2015. In 2010, 2011, 2012, 2013 and 2014 he was named by Canadian Lawyer Magazine as one of the top 25 Most Influential Lawyers in Canada.

Mr. Arvay is a Fellow of the Litigation Counsel of America and a Fellow of the American College of Trial Lawyers.

In 2012, Mr. Arvay was the University of Toronto’s Asper Centre’s inaugural Constitutional Litigator in Residence and the York University’s Osgoode Hall McMurtry visiting clinical fellow.

Mr. Arvay was elected Bencher for Vancouver for the two-year term commencing in January 2014.