See event listings and more articles in this edition of Agri-News: December 20, 2021 issue

‘With 5 months before 2022 planting begins, Alberta farmers have a few months for the fertilizer situation to sort itself out,’ says Ryan Furtas, market analyst with Alberta government. ‘However, the most likely scenario for fertilizers is that the current high prices will continue throughout the winter and spring months of 2022.’

Canadian and Alberta agriculture is highly dependent on nitrogen-based fertilizers. Nitrogen production and products, namely ammonia and urea, are mainly produced at Alberta locations. Alberta producers supply the large demand from the prairie provinces as well as the rest of Canada. The lone export destination of Canadian-produced ammonia and urea is the United States. It is through the U.S. that Canadian producers are tied to the international price for nitrogen.

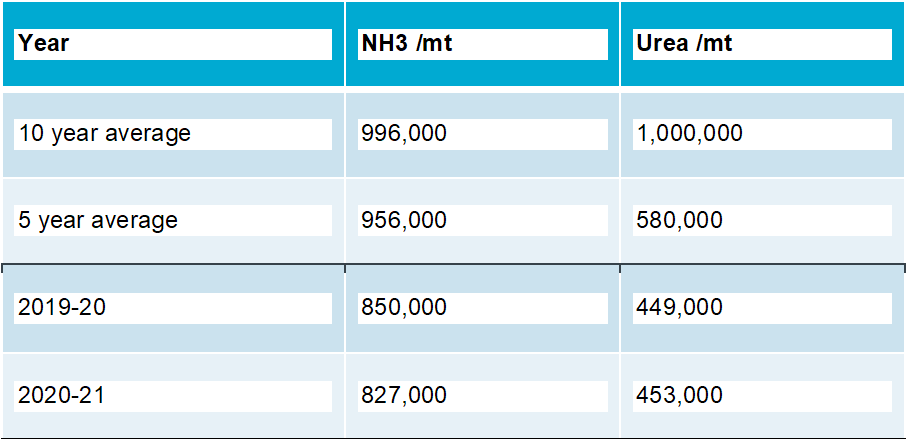

Figure 1 shows nitrogen fertilizer shipments to the U.S. from Canada. Fertilizer shipments are reported by quarter according to the fertilizer year that runs from July to June. Figure 1 also provides yearly fertilizer shipments to the United States.

Figure 1: Canadian fertilizer shipments to the United States – July to June (12 months)

Source: Statistics Canada.

‘Canadian exports of ammonia (NH3) averaged 956,000 metric tonnes (mt) and 996,000 mt for the past 5 and 10 years respectively. Of note, 2019/20 and 2020/21 ammonia exports decreased by approximately 100,000 mt or 10%.’

Furtas notes Canadian shipments of urea to the U.S. have sharply declined. The 10-year average shows approximately 1,000,000 mt of urea exported to the U.S., whereas the 5-year average comes in at 580,000 mt. In the past couple of years, export urea tonnage to the U.S. totaled 450,000 mt, which is a 20% decrease in exports over the 5-year average and a 55% decrease over the 10-year average.

In the past 5 years, the U.S. has added 5 million tonnes to the country’s production capacity base. This has made the U.S. less reliant on imports of both ammonia and especially urea from Canadian sources.

‘It is likely that Canadian exports increase in 2021/22, since Canadian nitrogen production facilities will be producing as much as possible to take advantage of the high priced demand,’ says Furtas.

‘Even though shipments to the U.S. have increased during the first quarter of the fertilizer year, it is worth noting that U.S. farmers throughout the northern plains, eastern sections and majority of the corn belt just finished a productive fall nitrogen (ammonia) application season. This is a small slice of good news for Alberta producers as it lessens later demand for nitrogen and allows inventories to rebuild for the upcoming spring.’

Contact

Connect with Ryan Furtas:

Hours: 8:15 am to 4:30 pm (open Monday to Friday, closed statutory holidays)

Phone: 780-422-7095

Toll free: 310-0000 before the phone number (in Alberta)

Email: [email protected]

For media inquiries about this article:

Phone: 780-422-1005

Sign up for Agri-News

Start every Monday with the week’s top agricultural stories and latest updates.

Read about all things agriculture at Alberta.ca/agri-news